Leidos Holdings, Inc. (LDOS)

Dividend Date & History

Sign Up for Free

Dividend Data

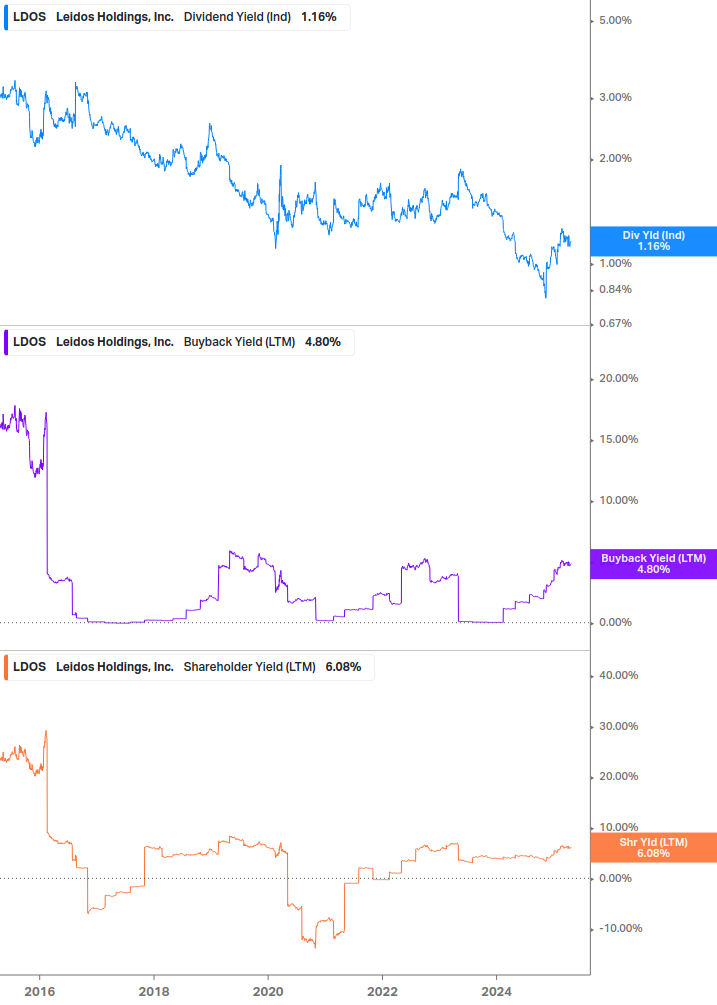

Leidos Holdings, Inc.’s (LDOS) dividend yield is 1.16%, which means that for every $100 invested in the company's stock, investors would receive $1.16 in dividends per year.

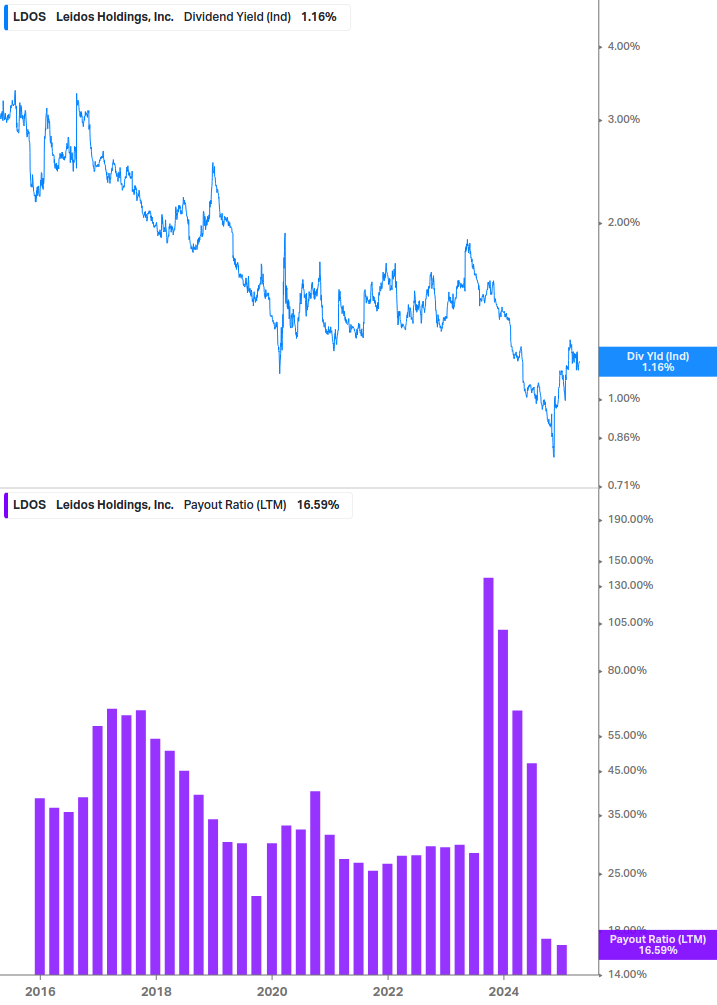

Leidos Holdings, Inc.’s payout ratio is 16.59% which means that 16.59% of the company's earnings are paid out as dividends. A low payout ratio may indicate that the company has a strong financial position and can invest in growth opportunities, while a high payout ratio may indicate that the company is returning most of its earnings to shareholders. LDOS’s annual dividend is $1.60 per share. This is the total amount of dividends paid out to shareholders in a year.

Leidos Holdings, Inc.’s (LDOS) ex-dividend date is , which means that buyers purchasing shares on or after that date will not be eligible to receive the next dividend payment.

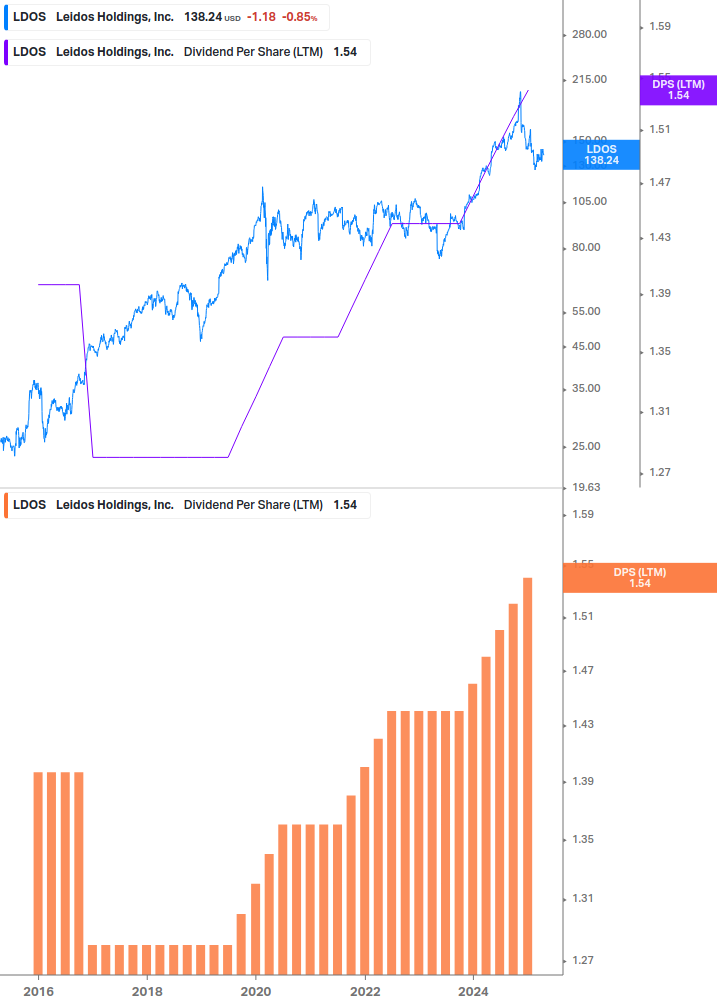

Leidos Holdings, Inc. (LDOS) pays dividends on a quarterly basis. Leidos Holdings, Inc. (LDOS) has increased its dividends for 7 consecutive years. This is a positive sign of the company's financial stability and its ability to pay consistent dividends in the future.

Dividend History and Growth

Leidos Holdings, Inc. (LDOS) dividend payments per share are an average of 5.48% over the past 12 months, 3.23% over the past 36 months, and 3.13% over the past 60 months.

It is important to note that LDOS’s dividend history and growth can be affected by many factors, such as profitability, cash flow, and financial stability, as well as its growth prospects and dividend payout policies. Add LDOS to your watchlist to be aware of any updates.

Dividend Growth Table

Dividend Growth Graph

Dividend Yield

LDOS dividend yield graph is a visual representation of Leidos Holdings, Inc.’s dividend yield over the last 12 months. This is useful for investors to understand LDOS’s historical dividend yield and to identify any trends or patterns in the company's dividend payments over time.

Dividend Yield Chart

Shareholder Yield

Shareholder yield is a metric that measures the total return to shareholders through dividends, buybacks, and debt paydown. It is a ratio that compares the cash returned to shareholders over a period of time to the market capitalization of the company.

Leidos Holdings, Inc. (LDOS) shareholder yield graph below includes indicators for dividends, buybacks, and debt paydown, which allows investors to see how each component contributes to the overall shareholder yield.

It's important to note that shareholder yield is just one metric among many that investors may use to evaluate a company's financial health and its potential for future growth. It should be considered in conjunction with other financial metrics such as earnings, revenue, and debt levels to get a comprehensive understanding of a company's financial position.

Shareholder Yield Chart

Dividend Safety

Dividend safety refers to the ability of a company to continue paying its dividends to shareholders without interruption or reduction. A company with a high level of dividend safety is generally considered to have a strong financial position, with a consistent history of paying dividends and a low risk of default.

Some specific indicators often used to assess Leidos Holdings, Inc. (LDOS) dividend safety include

- Dividend payment history: LDOS has a history of paying dividends and has consistently increased its dividend payout for 7 consecutive years.

- Dividend payout ratio: A low payout ratio, typically less than 60%, indicates that a company has enough earnings to pay dividends and retain earnings to reinvest in the business. Leidos Holdings, Inc.’s payout ratio is about 16.59%

It is worth noting that Dividend safety can change over time, and a company that was considered to have a high level of dividend safety in the past may no longer be considered safe today. Therefore, it is important to regularly monitor a company's financial performance and dividend payment history.

Dividend Safety Graph

Comparing Leidos Holdings, Inc. to Other Stock

The percentile ranks table is a way to compare Leidos Holdings, Inc. (LDOS) dividend yield relative to its sector, country, and the world.

- Dividend yield: LDOS’s latest value of 1.16% is the percentage of the current stock price that is paid out as dividends to shareholders. The relative to the sector, country, and world values (0.33, 0.19, and 0.3 respectively) indicate Leidos Holdings, Inc.’s dividend yield compared to others in its sector, country, and world. For example, a value of 0.19 relative to country means that Leidos Holdings, Inc.’s dividend yield is higher than 19% of companies in its country.

This table allows investors to quickly compare a company's dividend metrics to its peers in the sector, country, and the world, and evaluate its relative stability and growth potential.

Percentile Ranks Table

Dividend FAQ

Does Leidos Holdings, Inc. pay dividends?

Leidos Holdings, Inc. (LDOS) pays dividends to its shareholders.

How much is Leidos Holdings, Inc.’s dividend?

Leidos Holdings, Inc.'s (LDOS) quarterly dividend per share was $0.40 as of .

When is Leidos Holdings, Inc.’s ex-dividend date?

Leidos Holdings, Inc.’s latest ex-dividend date was on . The LDOS stock shareholders received the last dividend payment of $0.40 per share on .

When is Leidos Holdings, Inc.’s next dividend payment date?

Leidos Holdings, Inc.’s next dividend payment has not been announced at this time.

Does Leidos Holdings, Inc. have sufficient earnings to cover its dividends?

Leidos Holdings, Inc. (LDOS) has a low payout ratio of 16.59%, which is generally considered to be a sign that a company has enough earnings to pay dividends and retain earnings to reinvest in the business.