MetLife, Inc. (MET)

Dividend Date & History

Sign Up for Free

Dividend Data

MetLife, Inc.’s (MET) dividend yield is 3%, which means that for every $100 invested in the company's stock, investors would receive $3.00 in dividends per year.

MetLife, Inc.’s payout ratio is 39.02% which means that 39.02% of the company's earnings are paid out as dividends. A low payout ratio may indicate that the company has a strong financial position and can invest in growth opportunities, while a high payout ratio may indicate that the company is returning most of its earnings to shareholders. MET’s annual dividend is $2.18 per share. This is the total amount of dividends paid out to shareholders in a year.

MetLife, Inc.’s (MET) ex-dividend date is , which means that buyers purchasing shares on or after that date will not be eligible to receive the next dividend payment.

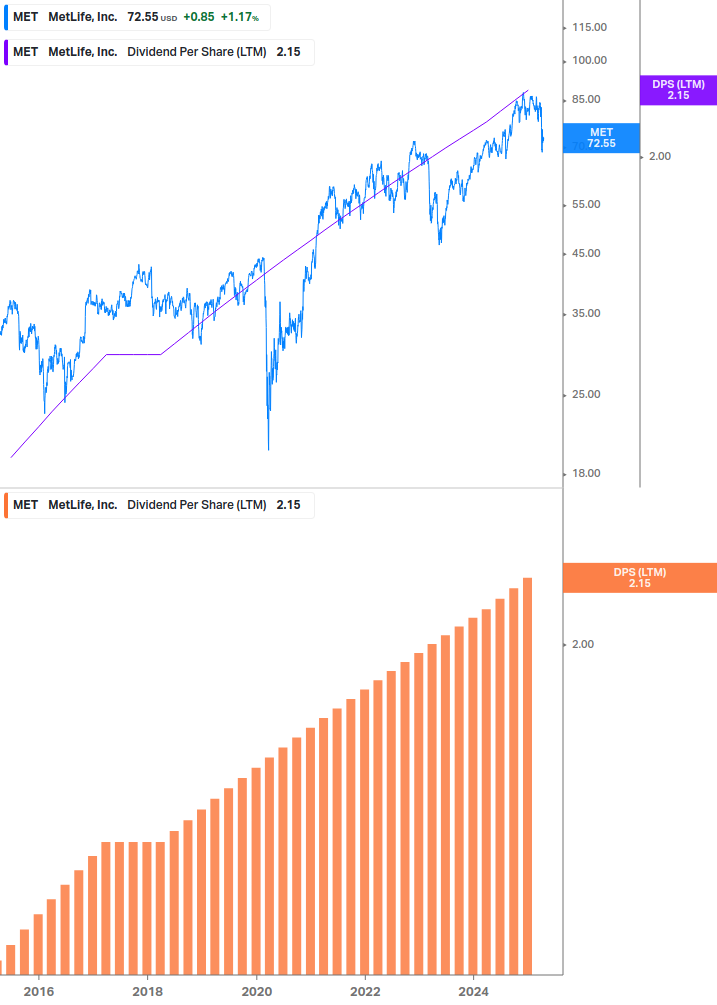

MetLife, Inc. (MET) pays dividends on a quarterly basis. MetLife, Inc. (MET) has increased its dividends for 12 consecutive years. This is a positive sign of the company's financial stability and its ability to pay consistent dividends in the future.

Dividend History and Growth

MetLife, Inc. (MET) dividend payments per share are an average of 4.61% over the past 12 months, 4.29% over the past 36 months, 4.37% over the past 60 months, and 4.98% over the past 120 months.

It is important to note that MET’s dividend history and growth can be affected by many factors, such as profitability, cash flow, and financial stability, as well as its growth prospects and dividend payout policies. Add MET to your watchlist to be aware of any updates.

Dividend Growth Table

Dividend Growth Graph

Dividend Yield

MET dividend yield graph is a visual representation of MetLife, Inc.’s dividend yield over the last 12 months. This is useful for investors to understand MET’s historical dividend yield and to identify any trends or patterns in the company's dividend payments over time.

Dividend Yield Chart

Shareholder Yield

Shareholder yield is a metric that measures the total return to shareholders through dividends, buybacks, and debt paydown. It is a ratio that compares the cash returned to shareholders over a period of time to the market capitalization of the company.

MetLife, Inc. (MET) shareholder yield graph below includes indicators for dividends, buybacks, and debt paydown, which allows investors to see how each component contributes to the overall shareholder yield.

It's important to note that shareholder yield is just one metric among many that investors may use to evaluate a company's financial health and its potential for future growth. It should be considered in conjunction with other financial metrics such as earnings, revenue, and debt levels to get a comprehensive understanding of a company's financial position.

Shareholder Yield Chart

Dividend Safety

Dividend safety refers to the ability of a company to continue paying its dividends to shareholders without interruption or reduction. A company with a high level of dividend safety is generally considered to have a strong financial position, with a consistent history of paying dividends and a low risk of default.

Some specific indicators often used to assess MetLife, Inc. (MET) dividend safety include

- Dividend payment history: MET has a long history of paying dividends and has consistently increased its dividend payout for 12 consecutive years.

- Dividend payout ratio: A low payout ratio, typically less than 60%, indicates that a company has enough earnings to pay dividends and retain earnings to reinvest in the business. MetLife, Inc.’s payout ratio is about 39.02%

It is worth noting that Dividend safety can change over time, and a company that was considered to have a high level of dividend safety in the past may no longer be considered safe today. Therefore, it is important to regularly monitor a company's financial performance and dividend payment history.

Dividend Safety Graph

Comparing MetLife, Inc. to Other Stock

The percentile ranks table is a way to compare MetLife, Inc. (MET) dividend yield relative to its sector, country, and the world.

- Dividend yield: MET’s latest value of 3% is the percentage of the current stock price that is paid out as dividends to shareholders. The relative to the sector, country, and world values (0.45, 0.51, and 0.56 respectively) indicate MetLife, Inc.’s dividend yield compared to others in its sector, country, and world. For example, a value of 0.51 relative to country means that MetLife, Inc.’s dividend yield is higher than 51% of companies in its country.

This table allows investors to quickly compare a company's dividend metrics to its peers in the sector, country, and the world, and evaluate its relative stability and growth potential.

Percentile Ranks Table

Dividend FAQ

Does MetLife, Inc. pay dividends?

MetLife, Inc. (MET) pays dividends to its shareholders.

How much is MetLife, Inc.’s dividend?

MetLife, Inc.'s (MET) quarterly dividend per share was $0.55 as of .

When is MetLife, Inc.’s ex-dividend date?

MetLife, Inc.’s latest ex-dividend date was on . The MET stock shareholders received the last dividend payment of $0.55 per share on .

When is MetLife, Inc.’s next dividend payment date?

MetLife, Inc.’s next dividend payment has not been announced at this time.

Does MetLife, Inc. have sufficient earnings to cover its dividends?

MetLife, Inc. (MET) has a moderate payout ratio of 39.02%, which may indicate a balance between reinvesting earnings and rewarding shareholders with dividends, seen as sustainable for future growth and reasonable dividend yield.